Person, a qib or qualified institutional buyer and a qp or qualified purchaser have the meanings given under u.s. Institutional buyer means any of the following entities (or any entity directly or indirectly through one or more intermediaries owning, controlling, owned by, controlled by or under substantially common control with such entity):

Sec Expands Accredited Investor Qualified Institutional Buyer Definitions - Red Oak Compliance Solutions

Any of the following entities, acting for its own account or the accounts of other qualified institutional buyers, that in the aggregate owns and invests on a discretionary basis at least $100 million in securities of issuers that are not affiliated with the entity:

Qualified institutional buyers examples. A qualified institutional buyer (qib), in united states law and finance, is a purchaser of securities that is deemed financially sophisticated and is legally recognized by securities market regulators to need less protection from issuers than most public investors. A qib is an individual entity that legally requires less protection from issuers than other public investors. Each purchaser severally represents that (a) it is a u.s.

Person, as defined in regulation s under the securities act, (b) it is a qualified institutional buyer (qualified institutional buyer) as that term is defined in rule 144a under the securities act and a qualified purchaser (qualified purchaser) within the meaning of section 3(c)(7) of the investment company act of 1940, as amended, acquiring the notes. Qualified institutional buyers are those institutional investors who are generally perceived to possess expertise and the financial muscle to evaluate and invest in the capital markets. A qualified institutional buyer (qib) is a financially sophisticated investor.

Qualified purchaser examples say, for instance, three investors apply to a private equity fund: An investment bank, insurance company, bank, savings and loan association, trust company, commercial credit corporation, employee benefit plan, pension plan, pension fund or pension. Typically, a qib is a company that manages a minimum investment of $ 100 million in securities on a discretionary.

A qualified institutional buyer (qib) is a class of investor who, by virtue of being a sophisticated investor, does not require the regulatory protection that the registration provisions of the securities law grant to investors. A completed rule 144a qualified institutional buyer certification form for each of the applicants equity owners list the names of the applicants owners for which a completed rule 144a qualified institutional buyer certification form is. Commercial banks and savings and loans ;

The range of entities who are deemed to be qualified institutional buyers also includes banks, savings, and loans associations (which must have a net worth of $25 million), investment and. The range of entities considered qualified institutional buyers include: To support its ability to qualify as a qib.

Rule 144a is a safe harbor exemption from the act of 33. Investment banks and companies ; Qualified institutional buyer (qib) shall mean:

Their status is the result of experience, assets under management, or net worth. And employee benefit plans under erisa. In a nutshell, the position of a qib can be described as follows.

Person who is not both a qib and a qp (or any investor who holds spark infrastructure securities for the account or benefit of any us person who is not both a qib and a qp) is an excluded us person (a u.s. However, any corporation, partnership, or llc could qualify as a qib. Qualified institutional buyers means institutional investors including, without limitation, insurance companies, funds and state or federally chartered financial institutions, or other entities which are fully qualified to buy private placements under securities exchange commission rule 144a.

The 144a market, therefore, allows issuers to raise capital by selling securities to large institutional investors and avoid the cost and delay associated with. Individuals can never be qibs, regardless of their assets or financial sophistication. Examples of qualified institutional buyer in a sentence any u.s.

A qualified institutional buyer ( qib ), in united states law and finance, is a purchaser of securities that is deemed financially sophisticated and is legally recognized by securities market regulators to need less protection from issuers than most public investors. The current list of institutions eligible for qualified institutional buyer status if they meet this $100 million in securities owned and invested threshold, include: So can an iai that owns at least $100 million in securities.

Islands, guam, american samoa, wake island and the northern mariana islands) or the district of columbia or (ii) a qualified institutional buyer (as defined in rule 144a under the securities act) and (d) if you are a person in the united kingdom, then you are a person who (i) The initial purchaser represents and warrants to, and agrees with, the company that it is a qualified institutional buyer and an accredited investor within the meaning of rule 501 (a) under the 1933 act.

Rii Nii And Qib Difference Explained 2021 -

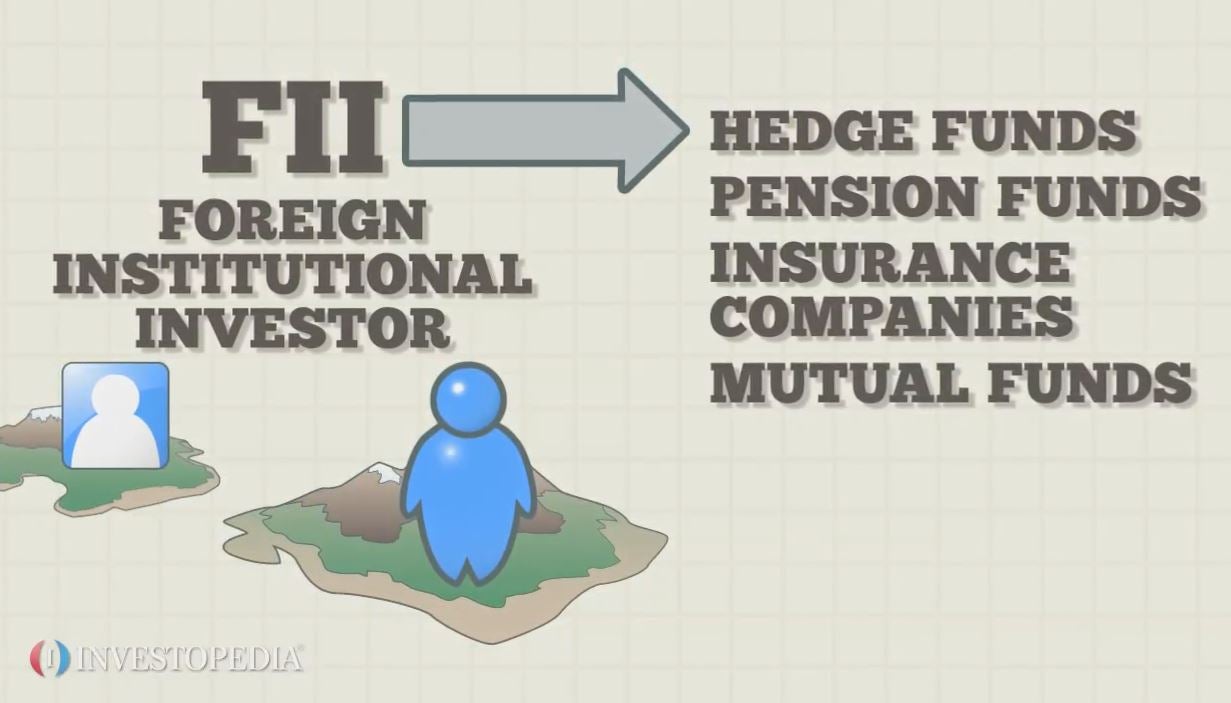

Startup Ipos The Contrarian View Of Domestic And Foreign Institutional Investors - Businesstoday

Qualified Institutional Buyer Qib Definition

What Is A Qualified Institutional Buyer And How Are Qualified Institutional Buyers Regulated - Ipleaders

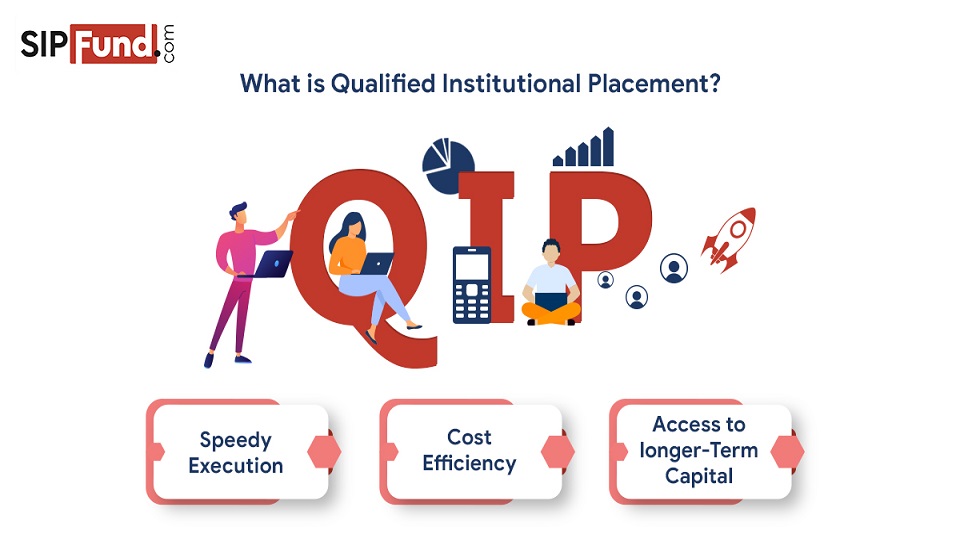

What Is Qualified Institutional Placement Qip - Yadnya Investment Academy

Shares - Ppt Download

Buying Process Of Individual Buyers And Institutional Buyers Notes Videos Qa And Tests Grade 12marketingcomponents Of Marketing Kullabs

Pw9soys5ysu_pm

Qip - Everything An Indian Retail Investor Need To Know About It - Shabbir Bhimani

Qib -- Qualified Institutional Buyer -- Definition Example Investinganswers

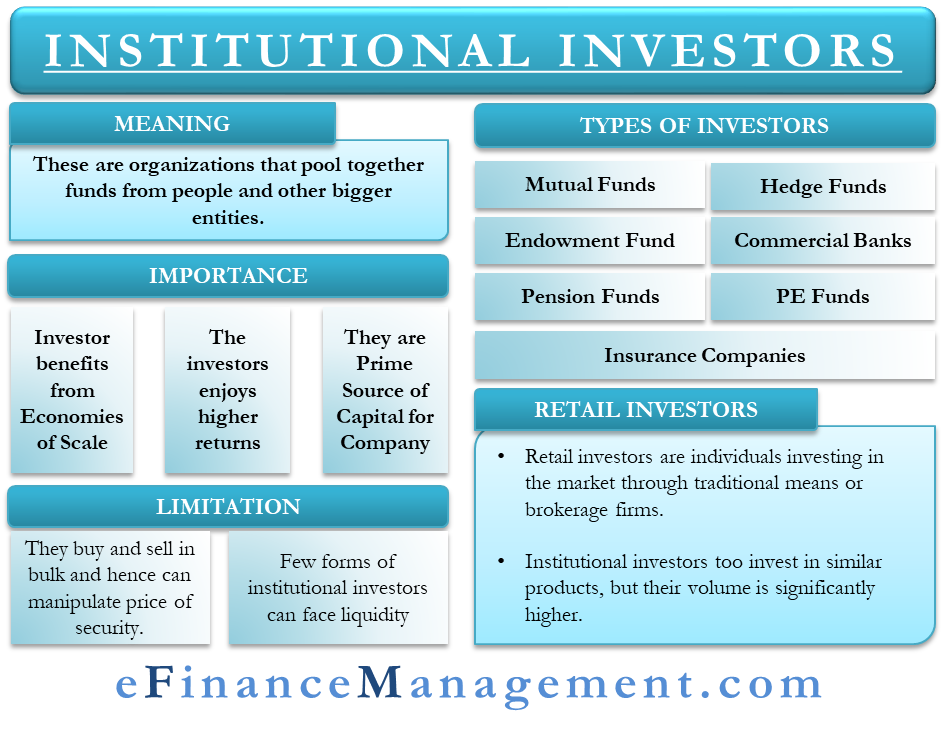

Institutional Investors - Efinancemanagement

Institutional Vs Retail Investors Why Individuals Are At A Disadvantage Crux Investor Articles

What Is The Difference Between Hni And Nii Investors In An Ipo - Quora

/stock-investment-1005214296-30d800870e74467890748c3962b5e510.jpg)

Qualified Institutional Buyer Qib Definition

Who Are Institutional Investors

Accredited Investor Vs Qualified Purchaser Whats The Difference Candor

What Is A Qualified Institutional Placement Qip

Foreign Institutional Investor Fii

All You Need To Know About Qualified Institutional Placement Qip And Qualified Institutional Buyer Qib -atif Ahmed - Bw Legalworld

Qualified Institutional Buyers Examples. There are any Qualified Institutional Buyers Examples in here.